The project is consists of three adjacent exploration and conditional underground mining licences known as Lochinvar, Lochinvar North and Lochinvar south. All three licences are 100% owned by NAE.

Historic exploration at Lochinvar was commenced in the 1950’s by the National Coal Board, which sank an initial four boreholes. This work proved the existence of the same sequence of thick coals of the Middle Coal Measures, which had been previously mined at Rowanburn colliery, within the Lochinvar North licence.

From 1979 to 1983 the NCB drilled a further nine boreholes and shot 55 kilometres of seismic lines, proving the existence of a large concealed coking coalfield (the Canonbie Coalfield), now known as the Lochinvar Coking Coal project.

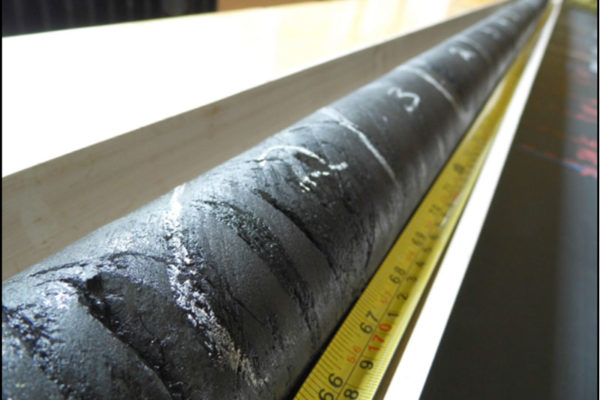

NAE acquired the Lochinvar licence in 2012 and drilled an initial 4 cored drill holes at Lochinvar in 2013 and a further 6 holes in 2014.

Scoping Study Results

In October 2014, NAE completed the Lochinvar Scoping Study which confirmed the potential for a low cost long life 1.9Mtpa long wall mining project to deliver 1.4Mpta coking coal to UK and European markets.

The Scoping Study was updated in March 2017 and delivered a robust set of economics highlighted by a post-tax NPV9% of US$410M with and IRR of 27% and a payback of 4 years.

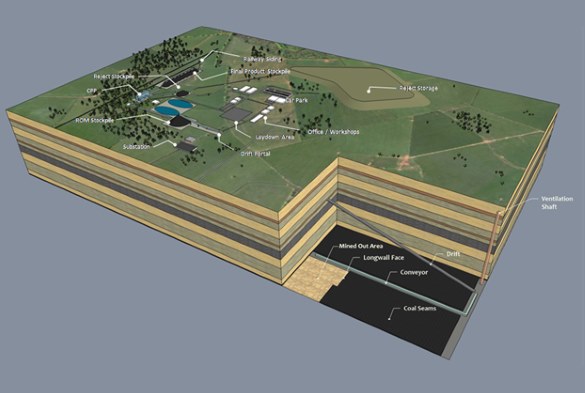

The project is focused on an underground mine connected by a drift to the surface, where coal will be processed and loaded into rail wagons – for direct delivery to the UK steel mills for shipping into Europe.

Underground coal will be mined using a 200m wide longwall with development roadways constructed by 3 continuous miner/ bolters.

The ROM coal will be processed at a high 71% yield to produce 33.7 Mt of clean coal (saleable product), averaging 1.4 Mtpa clean coal.

Lochinvar Scoping Study Production Schedule

Lochinvar Schematic Mine and Infrastructure Layout

Summary Economic Results – Lochinvar Scoping Study Update (March 2017)

| Parameter | Unit | Result | |

|---|---|---|---|

| Production | LOM ROM | Mt | 47 |

| LOM Saleable Coal | Mt | 34 | |

| Life of Mine | Years | 26 | |

| Annual Ave. ROM | Mt | 1.9 | |

| Annual Ave. Saleable Coal | Mt | 1.4 | |

| Revenue | Benchmark HCC Price | US$/t | 160 |

| Ave. Realised Price | US$/t | 150 | |

| Average Discount | % | 6 | |

| Operating Costs | Unit Operating Cost | US$/t | 58 |

| Capital Costs | Construction Capital | US$ M | 229 |

| Life of Mine Capital | US$ M | 513 | |

| Cash | Annual Cash | US$ M pa | 95 |

| Operating Margin | US$/t | 92 | |

| Valuation1 | Post-Tax NPV (@9% D.R.) | US$ M | 410 |

| IRR (Post-Tax) | % | 27 | |

| Payback (undiscounted) | Years | 4 |

1Real after tax, unleveraged, 1 Jan 2017 basis

These results demonstrate the potential for Lochinvar to deliver excellent returns on investment with lowest quartile operating costs and a low capital cost structure.

Geology

Geological data collected from the two phases of NAE drilling and a re-interpretation of historic seismic data has improved the understanding of the Lochinvar structure.

Palaris completed a revised structural interpretation in August 2014, which identified an increased density of faulting compared to the previous interpretation. The Scoping Study Mine plans are based on this revised structural interpretation.

This Resource occurs between 200m and 1,000m depth, with 95 Mt of the total resource, being shallower than 800m depth. All of the Indicated Resource is shallower than 800m depth.

Average seam thickness is 2.2m for the Nine Foot Seam and 1.8m for the Six Foot Seam.

Resource

A total coking coal resource of 111 Mt comprising 49 Mt Indicated Resource and 62 Mt Inferred Resource has been defined within the Lochinvar licence by Palaris for the Nine Foot and Six Foot Seams within the Lochinvar licence.

The Indicated Resource, Inferred Resource and Exploration Target have been reported in accordance with the JORC Code (2012) and have been independently estimated by Palaris Australia Pty Ltd, an internationally recognised mining consultancy specialising in coal exploration and mining. The resource estimate is based on 9 holes drilled by the National Coal Board (NCB) from 1979 through to 1983 and 10 holes drilled by NAE in 2013 and 2014.

An additional Exploration Target of 31 – 64Mt has also been identified which includes both the Lochinvar and Lochinvar South Leases.

A further Exploration Target for the Lochinvar North licence of 77-142 Mt was estimated by Palaris in April 2019.

The potential quantity and quality of the Exploration Targets is conceptual in nature. Insufficient exploration has been undertaken to estimate a Mineral Resource and it is uncertain that further exploration will result in the estimation of a Mineral Resource.

Lochinvar Resource Statement (August 2014)

| Coal Seam (Air Dried Basis) |

Indicated Resource (Mt) |

Inferred Resource (Mt) |

Total Resource (Mt) |

|---|---|---|---|

| Nine Foot Seam | 37 | 49 | 86 |

| Six Foot Seam | 13 | 13 | 26 |

| Total | 49 | 62 | 111 |

Lochinvar North Licence

An Exploration Licence, Conditional Mining Licence and Option Agreement were granted to NAE in April 2019 by The Coal Authority over an area of 66.5 km2 adjoining and to the north and east of the existing Lochinvar Licence (“Lochinvar North Licence”).

Localised coal mining occurred within the Lochinvar North Licence from the mid-1800’s to the early 1920’s in the eastern part of the coalfield, where the coal seams are exposed near the surface.

4 historic boreholes drilled by the National Coal Board in the 1950’s within the Lochinvar North Licence intersected the Nine Foot Seam and/or the Six Foot Seam. These boreholes confirm the continuity of the Nine Foot Seam and other coal seams within the Lochinvar North Licence.

Based on these NCB borehole Intersections, the Nine Foot Seam has an average thickness of 4.1m and the Six Foot Seam has an average thickness of 1.8m within the Lochinvar North Licence. These intersections show a thickening of the coal seams, when compared to the adjacent Lochinvar Licence to the west and southwest.

Coal sampling results on the NCB borehole intersections demonstrate coking coal properties consistent with the coking coal quality recorded in drilling by NAE in the adjacent Lochinvar licence.

Scottish Coal drilled a series of holes north of the Lochinvar Licence (“Bogrie holes”) which intersected coal seams of similar thickness to those encountered at the northern part of Lochinvar Licence and suggest shallower underground access to first coal.

Lochinvar North has the potential to extend the Lochinvar resource, reduce the depth to first coal (reducing the length and cost of the decline), increase production rate and increase mine life.

An Exploration Target for the Lochinvar North Licence ranging from 77-142 million tonnes has been estimated by independent technical consultants, Palaris, in the Nine Foot and/or Six Foot Seams to a maximum depth of 1,000m and minimum thickness of 1.2 m.

The potential quantity and quality of the Exploration Targets is conceptual in nature. Insufficient exploration has been undertaken to estimate a Mineral Resource and it is uncertain that further exploration will result in the estimation of a Mineral Resource.

Lochinvar North Exploration Target

| Description | Tonnage Range (Mt) |

|---|---|

| Nine Foot Seam Only | 77-104 Mt |

| Nine Foot Seam plus Six Foot Seam | 105 -142 Mt |

| Lochinvar North Licence Exploration Target | 77-142 Mt |

Coal Quality

Lochinvar Coal is comparable to highly sought after US High Volatile A Hard Coking Coal.

Wood Mackenzie completed an assessment of the expected Lochinvar coal specification compared with commonly traded industry standard benchmark coking coals with key findings as follows:

- Very Low Ash & Phosphorus

- Comparable VM, CSN, CSR (Predicted) & Fixed Carbon

- High Sulphur but within UK / Europe blend limits. Potential to reduce to 1.2% based on coal processing modelling

- Lochinvar Fluidity has wide range in results which were affected by laboratory media

- Lochinvar CSR has been predicted by Pearson Coal Petrography. Bulk samples and CSR tests are planned to determine actual CSR

These results confirm the potential for Lochinvar to produce a low ash high volatile coking coal product at a high yield that will be attractive to the UK and European steel industry.

Market and Infrastructure

Lochinvar is ideally located to become a supplier of low cost, high volatile hard coking coal to the European steel industry as a result of:

- Located 7km from the main West Coast Main Line railway – which links directly to UK steel mills and nearby ports to access European market

- Lower labour rates when compared to Australian mining costs

- Excellent UK fiscal regime with low corporate taxes and royalties

- European Metallurgical Coal imports forecast to grow from around 52Mt (2017) to 61Mt (2035)

- European High Volatile Hard Coking Coal (HV HCC) imports forecast to increase from 10.4Mt (2017) to 15.9Mt (2035)

- Lochinvar 1.4Mtpa annual production represents ~12% of UK/Europe High Volatile HCC coking coal imports in 2021

- Lochinvar coal enjoys a clear distance and freight cost advantage over competing imported coal and the benefit of regular local deliveries reducing customer inventories.

Optimisation Study and Bord and Pillar Mining Potential

An optimisation study undertaken in September 2019 by technical consultants, Palaris, identified several opportunities for improvement with the project including;

- Opportunity to reduce ventilation shaft construction cost based on revised contractor quotes

- Opportunity to reduce costs of initial underground roadway development to reach first longwall mining panel based on updated estimates by Palaris

- Addition of a single Bord and Pillar mining panel to produce salable coal during the 2-year project construction period and prior to coal production from the first longwall panel.

The study also highlighted the potential for extended use of Bord and Pillar underground mining method at Lochinvar:

- Expected Bord and Pillar mining costs at Lochinvar appear to be competitive with other international Bord and Pillar underground coal mining operations benchmarked by Palaris

- Bord & Pillar mining expected to be possible at Lochinvar to depths less than 400 m from the surface where geotechnical conditions are typically more benign than at greater depths

- 33 Mt of the total Lochinvar coking coal resource in the Nine Foot seam is between 200 m and 400 m deep and has potential to be mined via the Bord and Pillar underground mining method. Of this, 21.2 Mt is in the Indicated Resource category and 11 Mt is in the Inferred Resource category

- An additional 7 Mt of coal resource in the Six Foot Seam between 200m and 400m depth of cover also has the potential to be mined via the Bord & Pillar method

- The Exploration Target within the Lochinvar North licence may also offer potential for Bord and Pillar mining, subject to further exploration and confirmation of resources

- Although the Bord and Pillar mining method is slightly more expensive than the longwall mining method, it has a number of significant advantages including; significantly lower start-up capital costs, increased flexibility to accommodate faulting and geological structure encountered in mining and to manage coal quality variation within the deposit, increased ability to scale production rate to meet market demands by adding/removing continuous miner units

- NAE now plans to further study the potential for an extended Bord and Pillar underground mining operation at Lochinvar, prior to the commencement of longwall mining.